Toto, We're Not In Kansas Anymore

Toto, We're Not In Kansas Anymore

In a recent CE class, several Realtors tried to explain how to view 2021 using their personal experiences since entering real estate in the last 10 to 15 years. It was as enlightening as it was frustrating because it cannot be done.

Just as we could not use the lessons of 1929 (Stock Market Crash) only 11 years later to manage the events of 1940 (WWII), we could not use the lessons of 1950 (Korean War) just 11 years later to manage the events of 1961 (Space Program). And, neither can we use the lessons of 2010 (housing bubble) to manage in 2021 (global pandemic).

For instance, in real estate, there are three tried-and-true approaches to valuing a property but what happens when existing inventory is so low and new construction is so scarce that neither the Law of Substitution, the Market Approach nor the Cost Approach can be effectively applied? How does the seller know how much to ask or the buyer know how much to offer?

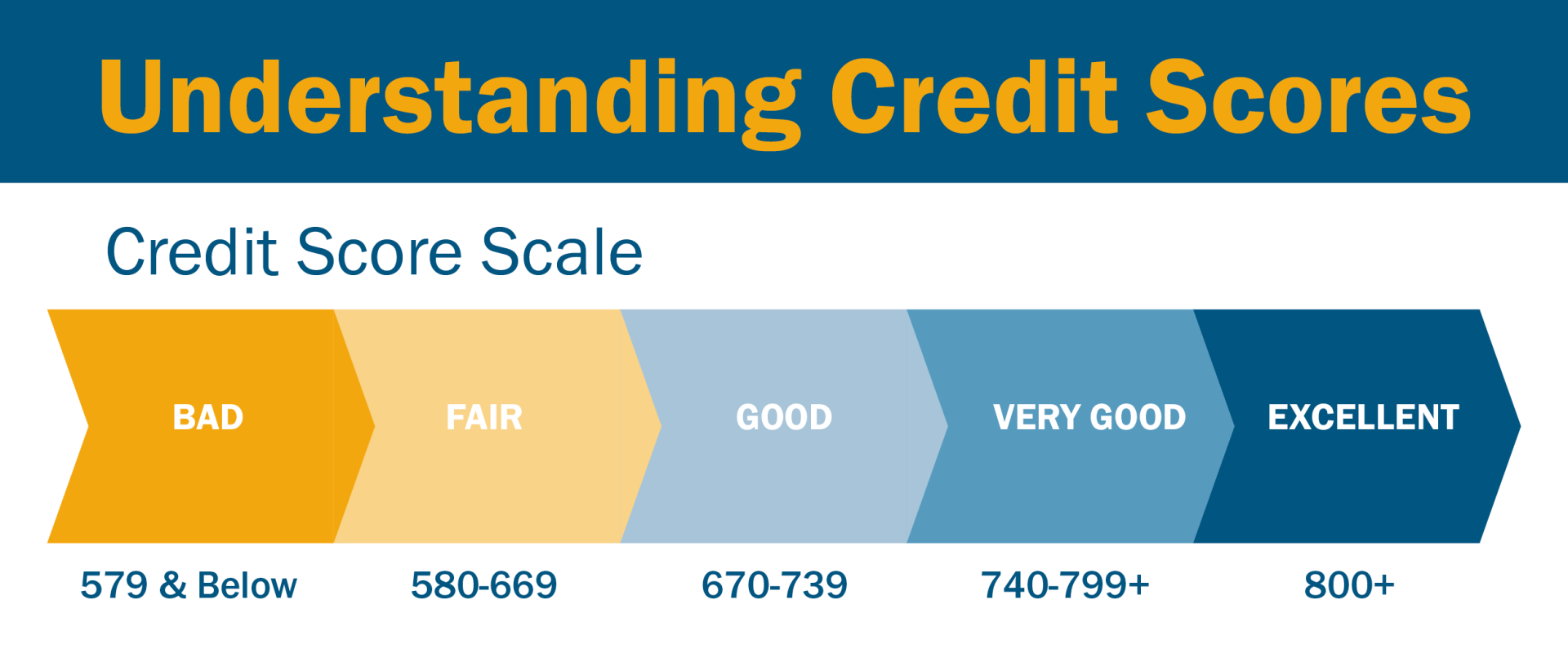

Add to the mix a plethora of global institutional investors who, after exhausting opportunities in equities, ETFs, emerging markets and rare metals, refocused on residential real estate. My real estate courses never explained what would happen when institutional investors with millions of dollars in cash would compete with families simply hoping to qualify for a mortgage to buy a house because it had never existed before.

Then there was COVID-19 when thousands of office workers moved to their spare bedrooms only to discover they could also move to less crowded, less expensive locales and keep their job. In 2010, 10% of workers worked remotely at least once a week. Today, the number is 25% and growing. Did an appraiser ever consider a possible pandemic’s effect on dense, expensive center city housing when valuing a proposed high rise? Does anyone remember a chapter in his/her training on the needs & wants of remote workers?

For at least four generations, owning real estate has been the cornerstone of the American Dream, a way to grow wealthy but what happens when, instead, your employer will help you grow wealthy through its 401(k) plan and you can retain more freedom of movement renting your crib than owning it?

Because of low inventory, scarce new construction, institutional investors, COVID-19, alternative investments and many other factors, 2021 is not like 2010 and cannot be viewed or managed using an 11 year old perspective.

To paraphrase Dorothy Gale, “Toto, We’re not in Kansas anymore” and we’re not in 2010 either.

Rental Real Talk